FOR THIS WEEK

GO SHORT ABOVE 4995 LEVEL & ALSO NEAR TO 5030 LEVEL WITH SL-5045 LEVEL TARGET 4960,4920

GO LONG BELOW 4920 LEVEL & ALSO NEAR TO 4885 LEVEL WITH SL-4870 LEVEL TARGET 4950,4995

NIFTY NEED TO CLOSE ABOVE 4900 LEVEL IN THIS WEEK, IF CLOSED BELOW THEN GO SHORT WITH SL4950 FOR FULL OCTOBER MONTH (TARGETS 4800,4660,4550).

TODAY

BUY NIFTY AROUND 4925-4940 FOR A TARGET1-4955, TARGET2: 4980 keep SL-4910

SELL NIFTY AROUND 4995-4975 FOR A TARGET1-4960, TARGET2: 4940 keep SL-5005

SHORT-TERM ASCENDING TRIANGLE CHANNEL ALREADY BROKEN. NIFTY NOW TARGETING 4800 LEVEL.

BUY NIFTY AROUND 4925-4955 FOR A TARGET1-4985, TARGET2: 5020 keep SL-4910

SELL NIFTY AROUND 5050-5015 FOR A TARGET1-4980, TARGET2: 4945 keep SL-5060

NIFTY TREND CHART

NIFTY GANN'S CHART

NIFTY FIBONACCI LEVELS

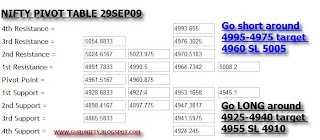

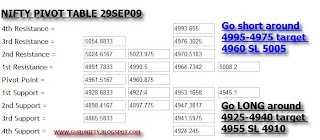

NIFTY PIVOT TABLE

TODAY IF NOT ABLE TO CROSS & HOLD 4988 LEVEL THEN PANIC SELLING TILL 4945 LEVEL NOT RULED OUT.

BEFORE A BIG FALL NIFTY NEED TO REACH 5176+++ LEVEL. SO STRATEGY SHOULD BE BUY ON DIPS WITH MAJOR SUPPORT AS STOP-LOSS(4800 LEVEL)

TODAY NIFTY HAS A CHANNEL SUPPORT@4935 LEVEL.

BUY NIFTY AROUND 4930-4945 FOR A TARGET1-4970, TARGET2: 4995 keep SL-4910

SELL NIFTY AROUND 5010-4990 FOR A TARGET1-4970, TARGET2: 4945 keep SL-5020

NIFTY PIVOT TABLE

NIFTY FIBONACCI CHART

NIFTY TREND CHART

NIFTY WAVE CHART

SHORT TERM RISING WEDGE SUPPORT@4972/RESISTANCE@5058 LEVEL .

TODAY MAXIMUM NIFTY CAN GO UP TO 5058 LEVEL

ON THE OTHER-SIDE, IF 4972LEVEL BREAKS THEN MAJOR SUPPORT AROUND 4850-4800LEVEL.

BUY NIFTY AROUND 5000-4985 FOR A TARGET1-5020, TARGET2: 5040 keep SL-4970

SELL NIFTY AROUND 5055-5040 FOR A TARGET1-5020, TARGET2: 4990 keep SL-5060

NIFTY SWING CHART

NIFTY GANN CHART

NIFTY HOURLY CHART

NIFTY TREND CHART

NIFTY PIVOT TABLE

11:45AM

------------------------------------------------------------------------------------------------------------------------------------------------------

AS CHINA BROKEN CRUCIAL SUPPORT 2934 LEVEL, PANIC SELLING WILL TAKE UP TO 2854-2827(NOT RULED OUT)

EXPECT THE UNEXPECTED, NIFTY MAY KISS 4890 LEVEL TODAY(LEVELS TO WATCH 4990 & 4945)

------------------------------------------------------------------------------------------------------------------------------------------------------

AS MENTIONED ON FRIDAY 5003 LEVEL WILL ACT AS LAKSHMAN REKHA.ONCE CROSSES 5003 LEVEL THEN NON STOP RALLY TILL 5040 LEVEL. BEYOND THAT WILL REACH 5078-5096(WEEKLY-BREAKOUT) LEVEL.

MAXIMUM IT CAN STRETCH UP TO 5216(+/- 50 POINTS).

ON THE DOWN SIDE IF 4950 BREAKS WITH VOLUME THEN NON-STOP SLIDE TILL 4910 LEVEL. BELOW 4910 WILL TAKE UP TO 4877-4856(WEEKLY BREAKOUT) LEVEL.

IF SEPTEMBER MONTHLY CLOSE BELOW 4900 LEVEL OR IN OCTOBER 4900 BREAKS THEN ?????

GO SHORT AROUND 4900 LEVEL WITH SL 4950 & SQUARE OF YOUR POSITION ON OCTOBER EXPIRY OR RISKY TRADERS CAN HOLD TILL NOVEMBER EXPIRY.

TODAY SELL NIFTY AROUND 5000-4990 LEVEL TARGET-4975 & 4955 keep SL-5015

TODAY BUY NIFTY AROUND 4950-4960 LEVEL TARGET-4975 & 4995 keep SL-4930

NIFTY GANN CHART

NIFTY TREND CHART

NIFTY TREND1 CHART

NIFTY MONTHLY CHART

NIFTY WEEKLY CHART

NIFTY SWING CHART

NIFTY PIVOT TABLE

NIFTY REACHED A MAXIMUM OF 5003 LEVEL YESTERDAY(WE ARE IN THE COMPLETION STAGE OF FINAL WAVE, SO PREVIOUS DAY HIGH WILL ACT AS LAKSHMAN REKHA)

IF NOT CROSSES 5003 THEN PANIC SELLING WILL TAKE UP TO 4890 LEVEL. IF CROSSES THEN WILL TARGET 5078-5095 LEVEL(100% UP MOVE FROM 2539 WILL COMPLETE@5078).

ONCE CROSSES & STAYED ABOVE 5078-5095 LEVEL WILL TAKE UP TO A MAXIMUM 5216 LEVEL(YEARLY BREAKOUT LEVEL)

BUY NIFTY AROUND 4930-4945 FOR A TARGET1-4965, TARGET2: 4985 keep SL-4915

SELL NIFTY AROUND 5000-4980 FOR A TARGET1-4965, TARGET2: 4945 keep SL-5015

NIFTY ELLIOT WAVE CHART

NIFTY GANN CHART

NIFTY FIBONACCI CHART

NIFTY TREND CHART

NIFTY PIVOT TABLE

NIFTY ALREADY CLOSED ABOVE 4877 (MONTHLY BREAKOUT LEVEL) FOR TWO CONTINOUS DAYS & CLOSED ABOVE 4844(WEEKLY BREAKOUT LEVEL)AS WELL.

FOR ALL LONG'S KEEP SL@4940 LEVEL.

AS ALREADY MONTHLY BREAKOUT HAPPENED & IF NOW WEEKLY CLOSE ABOVE 4944 LEVEL WILL WON'T ALLOW NIFTY TO GO BELOW 4877 LEVEL TILL THIS MONTH END.

BUY NIFTY AROUND 4935-4920 FOR A TARGET1-4955, TARGET2: 4980 keep SL-4905

SELL NIFTY AROUND 5000-4980 FOR A TARGET1-4960, TARGET2: 4935 keep SL-5010

NIFTY SWING CHART

NIFTY GANN CHART

NIFTY FIBONACCI CHART

NIFTY PIVOT TABLE

MAJOR REVERSAL MAY HAPPEN TODAY AROUND 4940-4970 LEVELS OR IT WILL HAPPEN WITHIN2-3DAYS(ie WITHIN THIS WEEK).

I MEAN ONLY REVERSAL NOT THE MAJOR CHANNEL BREAKOUT OR MAJOR FALL. IT WILL HAPPEN ON OR AFTER EXPIRY DATE(24SEP09) ONLY.

BUY NIFTY AROUND 4842-4865 FOR A TARGET1-4890, TARGET2: 4920 keep SL-4830

SELL NIFTY AROUND 4940-4920 FOR A TARGET1-4890, TARGET2: 4865 keep SL-4950

NIFTY LONG & MID-TERM SWING CHART

NIFTY GANN'S CHART

NIFTY FIBONACCI(LONG-TERM) & EXISTING/SHORT-TERM SWING CHART

FIBONACCI REISTANCE @4980(50%) & SUPPORT@4730(38.2%).These fibonacci levels are the extension of the lower levels from 2539levels

NIFTY TREND CHART

NIFTY PIVOT TABLE

BUY NIFTY AROUND 4795-4785 FOR A TARGET1-4810, TARGET2: 4825 keep SL-4770

BUY NIFTYABOVE 4835 FOR A TARGET1-4855, TARGET2: 4878 keep SL-4810

NIFTY FIBONACCI CHART

NIFTY SWING CHART

NIFTY GANN'S CHART

NIFTY TREND

NIFTY TREND LEVELS

NIFTY PIVOT TABLE

SELL NIFTY AROUND 4825-4835 FOR ATARGET1-4805, TARGET2:4790 keep SL-4845

SELL NIFTY BELOW4775FOR ATARGET1-4755, TARGET2: 4730 keep SL-4790

BUY NIFTY AROUND 4790-4810 FOR A TARGET1-4830, TARGET2: 4850 keep SL-4775

BUY NIFTY AROUND 4750-4760 FOR A TARGET1-4790, TARGET2: 4830 keep SL-4730

SELL NIFTY AROUND 4850-4865 FOR A TARGET1-4830, TARGET2: 4805 keep SL-4875

NIFTY PIVOT TABLE

NIFTY TREND

NIFTY GANN CHART

NIFTY TREND1

NIFTY WEEKLY

BUY NIFTY AROUND 4770-4795 FOR A TARGET1-4820, TARGET2: 4845 keep SL-4760

SELL NIFTY AROUND 4865-4845 FOR A TARGET1-4820, TARGET2: 4795 keep SL-4880

DISCLAIMER

All the content mentioned in this blog is my personal journal and should not be taken as a trading advice. Please use the content purely for learning purposes. I may or may not be holding any positions in the stocks/contracts under discussion. I will not be responsible for your profits or losses